Tariffs and Turbulence in Crypto Markets

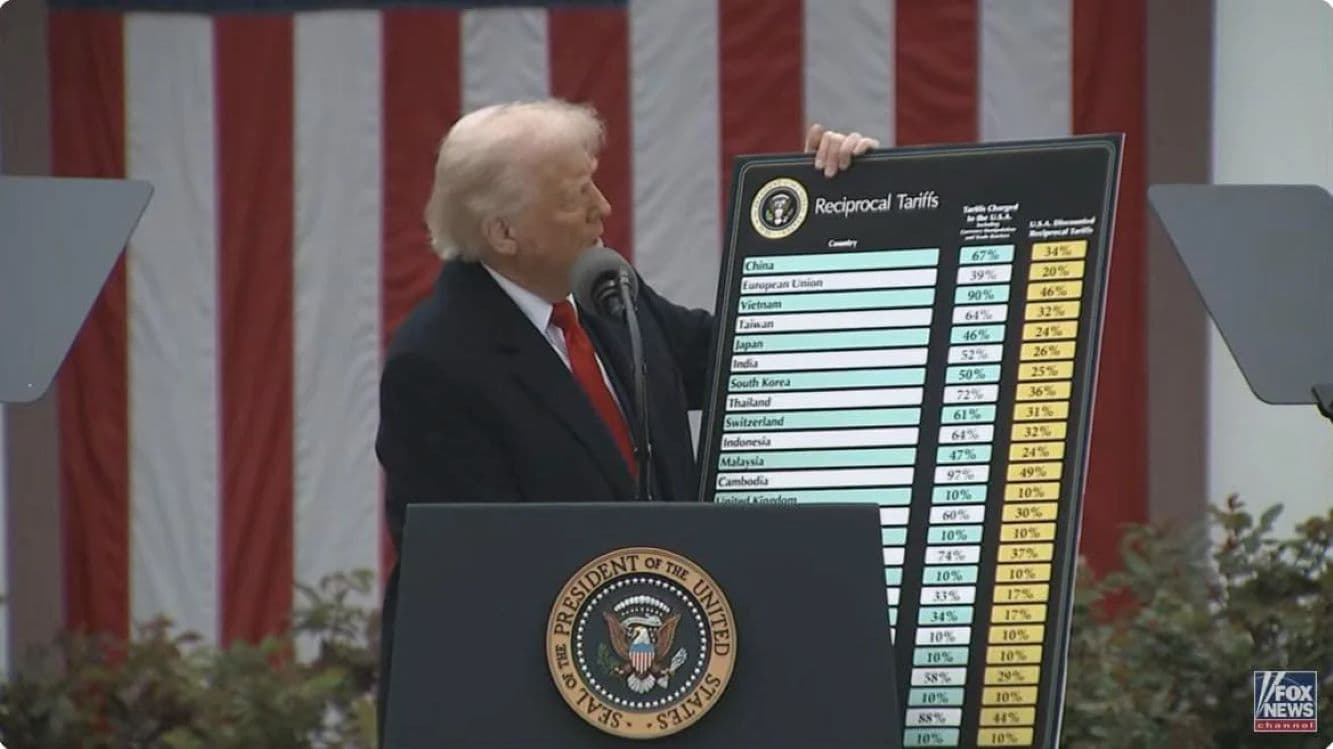

The cryptocurrency market has been thrown into turmoil following Donald Trump’s April 2, 2025 announcement of sweeping new tariffs. In early April, President Trump unveiled 25% tariffs on all foreign-made cars, a 10% baseline tariff on imports, and “reciprocal” levies on nations taxing U.S. goods. The policy bombshell immediately rattled global markets – and crypto was no exception. Bitcoin, which had been flirting with the $90,000 level on the day of the announcement, plunged within hours, reflecting a sudden risk-off shift among investors. Ethereum and Solana, along with other major altcoins, also saw sharp declines, underlining crypto’s sensitivity to macroeconomic shocks. This article analyzes the short-term shock and medium-term outlook for Bitcoin, Ethereum, and Solana in the wake of Trump’s tariff salvo, drawing on expert insights and market data to project where prices and sentiment could go next.

Notably, the tariff turmoil arrives just as crypto had been enjoying a post-election upswing. Trump’s victory in late 2024 initially buoyed digital assets amid hopes of a lighter regulatory touch; indeed, the new administration signaled a more crypto-friendly stance in its first quarter. But those positives have been overshadowed by the fallout from the trade conflict, which has introduced a new wave of uncertainty into an already volatile market. Traders and investors are now grappling with a fundamental question: Is this a temporary dip or the start of a deeper correction in crypto prices? The answer may lie in both short-term technical factors and medium-term macro trends that we explore below.

Immediate Market Reaction to Trump’s Tariffs

Trump’s tariff announcement delivered an immediate shock to cryptocurrencies, sparking a swift sell-off reminiscent of other risk assets. Within 24 hours of the April 2 news, Bitcoin tumbled nearly 5%, falling below the key $80,000-$82,000 range it had held. By the following Monday, Bitcoin briefly dipped under $75,000 – its lowest level since November 2024, effectively wiping out the gains made since Trump’s election win. Ether (ETH) fared even worse in the initial rout: it plunged about 14% in one day to around $1,550, marking its lowest price since early 2023. Solana (SOL), known for its high volatility, also dropped sharply – roughly 6% in the immediate aftermath – as panicked investors rotated into cash and stablecoins.

Market sentiment shifted from optimism to fear almost overnight. “For a moment, it seemed as though crypto might hold steady, but with the 24/7 nature of crypto markets, investors woke up on Sunday in full ‘sell mode’,” said Charlie Sherry, head of finance at BTC Markets. Indeed, over the first weekend of April, crypto became a leading indicator for broader market stress: the massive Sunday sell-off in Bitcoin foreshadowed Monday’s equity slump in the U.S. and Asia, illustrating how tightly correlated crypto and traditional markets remain. More than $868 million worth of bullish crypto bets were liquidated in 24 hours during the cascade, as over-leveraged traders were caught off guard by the tariff shock.

Trump’s protectionist turn immediately undermined investor confidence across the board. Hedge fund billionaire Bill Ackman – typically a Trump ally – warned that without a reversal, the country could be headed for an “economic nuclear winter” that would “crush business confidence”. Such dire macro warnings fueled a flight from riskier assets. Cryptocurrencies, often seen as high-risk, were sold alongside stocks and commodities in the days after the announcement. Even gold initially jumped on the news, only to fall back as investors scrambled for U.S. dollars and Treasury bonds in a classic safety trade. Bitcoin, sometimes dubbed “digital gold,” did not behave as a safe haven during the initial hours of the crisis – instead, it traded in line with equities, confirming its status (for now) as a risk-on asset.

However, the volatility also produced whipsaw moves. In a surprising twist, Bitcoin actually spiked to about $87,800 during Trump’s televised tariff announcement – a brief rally some attributed to algorithmic trades or speculation that a weakening dollar could benefit hard assets. But that spike was fleeting; within hours, reality set in and prices retreated sharply. By April 3, the crypto “Trump rally” had fully evaporated, replaced by a sobering new downtrend. As one analyst wryly noted, crypto’s initial attempt to decouple from the turmoil failed as “investors worldwide” moved to hedge against macro uncertainty in unison.

Short-Term Trends: Volatility, Correlation, and Key Levels

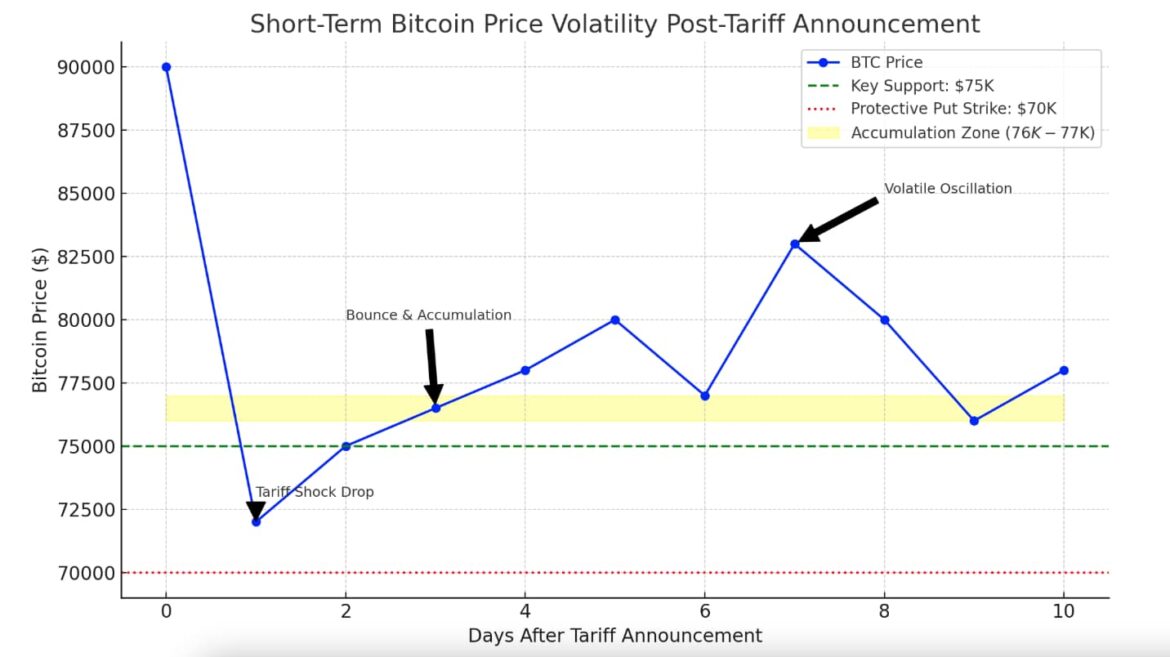

In the short term, the cryptocurrency market appears caught in a storm of volatility and close correlation with traditional assets. The abrupt drop following the tariff news has put traders on high alert for further downside. Options markets are flashing caution: demand for protective put options has surged, with open interest heavily skewed toward strikes around $70,000 for Bitcoin – suggesting many are hedging against the possibility of a fall toward that level. “Crypto is typically a leading indicator for risk assets,” observed Julia Zhou, COO at market maker Caladan, adding that one should “expect sharper corrections” in crypto ahead of any equity sell-off. In other words, if global stocks continue to sink under trade war fears, crypto could very well lead the descent.

All eyes are now on key support levels. For Bitcoin, the $75,000 mark – which it briefly undercut – is seen as an important support; a sustained break below that could open the door to the high-$60Ks. Ethereum’s analogous support rests around $1,500, a level it tested during the worst of the drop. Solana, which was trading in the mid-$20s to low-$30s range prior to the shock (based on its early 2025 trend), is watching support in the high teens and low $20s, according to technical analysts. Thus far, Bitcoin has managed to reclaim the upper-$70,000s in tentative bounces, and crypto-focused funds even saw some bargain-buying when BTC dipped into the $76K-$77K zone – a range that one institutional desk characterized as a potential accumulation area. “We like buying BTC on aggressive dips towards the 76-77k area,” noted Augustine Fan, Head of Insights at SignalPlus, hinting that deep-pocketed investors are ready to step in at those lower levels.

At the same time, trading volumes and volatility indices have spiked. The uncertainty around trade policy has pushed the Crypto Volatility Index (CVI) higher, and intra-day swings for Bitcoin of 5% or more are becoming common. Altcoins are seeing even bigger whipsaws: on April 3, as panic selling set in, Ethereum and Solana each plunged roughly 6% within hours before finding footing. Traders report a flight to safety within crypto itself – a rotation out of smaller altcoins and into stablecoins and Bitcoin during the height of the panic. In essence, the market is trading on headlines, reacting to each new tariff development or retaliatory measure announced. Until clarity emerges on the geopolitical front, this reactive, news-driven volatility is likely to continue.

Short-term sentiment is undeniably jittery. Yet, not everyone is outright bearish. Some analysts point out that if equity markets stabilize or if the Federal Reserve steps in with supportive policy, crypto could rebound quickly from oversold conditions. One optimistic view is that Bitcoin around the upper $70Ks might represent a short-term floor unless the macro situation significantly worsens. Initial data from exchanges showed large buy orders clustering around $72,000-$75,000 during the sell-off, indicating that institutional investors may be nibbling at lower levels even as retail traders capitulate. Still, caution is warranted: as veteran traders remind us, “never catch a falling knife” in markets. In the coming weeks, volatility is expected to remain elevated, and range-bound choppiness (with Bitcoin perhaps oscillating between roughly $75K and $85K) could dominate unless a new narrative takes hold.

Medium-Term Outlook: Risks and Opportunities Ahead

Looking beyond the immediate chaos, the medium-term trajectory for crypto will hinge on how the trade war and economic policies evolve in the next few months. Many experts believe that if the tariff standoff escalates into a prolonged trade war, it could act as a persistent headwind for risk assets, including cryptocurrencies. Tracy Jin, COO of MEXC Exchange, warns that the market’s recent behavior calls into question Bitcoin’s “safe haven” status. “In its current state, the market is easily manipulated… this will call into question the status of Bitcoin as a safe haven asset, which may lead to an even sharper outflow of funds from the ETF,” Jin explained. She argues that instead of acting like digital gold, Bitcoin has been trading more like a high-beta equity, and further disappointment could send it much lower. Jin’s team forecasts a worst-case scenario of Bitcoin dropping to the $52,000–$56,000 range by summer if macro conditions deteriorate. Under that grim scenario, Ethereum could potentially fall well below $1,300 (erasing a year or more of gains), and Solana and other high-flying alts might see drawdowns of 30-50% from their Q1 highs.

Yet the medium-term is not uniformly bearish. A number of analysts see potential upside catalysts for crypto on the horizon – contingent on how economic dynamics play out. One key factor is the U.S. dollar. Tariffs and trade tensions, by raising the cost of imports, can fuel domestic inflation and also risk slowing down economic growth. Should the U.S. economy soften considerably under the weight of tariffs, the Federal Reserve may be forced to pivot to interest rate cuts to support growth. “The slowdown in the US economy due to the introduction of new tariffs may push the Federal Reserve to resume cutting rates,” Jin notes, adding that a fall in Treasury yields and weakening dollar would eventually filter through to crypto markets. Lower interest rates typically benefit risk assets like Bitcoin by reducing the appeal of yield-bearing alternatives. Moreover, a weaker dollar could boost Bitcoin’s appeal as an alternative store of value. In effect, if the trade war leads to the Fed stepping on the gas, it might shorten the crypto downturn or even spark a new rally later in 2025.

Another scenario involves inflation and the “stagflation” risk. If tariffs drive up prices (some models project a 2-3% bump in CPI by Q2 2025 in a full-blown trade war while growth stagnates, investors could lose confidence in fiat currencies and traditional assets. “Trump’s proposed tariffs risk triggering stagflation — rising prices without growth — which could undermine confidence in fiat, especially the U.S. dollar,” explains Alvin Kan, COO at Bitget Wallet. “As capital seeks protection from inflation and trade war uncertainty, Bitcoin stands out as a neutral, decentralized hedge.

In a fragmented, protectionist world, BTC becomes less about speculation and more about preservation, and smart traders are already positioning accordingly,” Kan says. This view posits that Bitcoin’s “digital gold” narrative could reassert itself if the dollar’s dominance is dented by policy missteps. Indeed, protectionist policies that potentially weaken dollar hegemony could accelerate interest in decentralized alternatives over the medium-to-long term, (U.S. crypto stocks slide as Trump’s sweeping tariffs jolt markets | Reuters) notes Marcin Kazmierczak of blockchain firm RedStone. In plain terms, the longer Trump’s tariffs strain the traditional system, the more attractive crypto could become as an outside-the-system asset class.

Ethereum and Solana’s medium-term prospects will likely depend on both macro and their own fundamentals. Ethereum, while suffering lately, has significant network upgrades and institutional adoption on the horizon, which could help it rebound once macro pressures ease. Solana, for its part, entered 2025 with positive momentum – strong developer activity and even rumors of upcoming ETF products focused on SOL. Those fundamentals mean that if risk appetite returns later in the year, high-beta assets like Solana could outperform in a recovery. On the flip side, without a clear improvement in economic conditions, altcoins may struggle more than Bitcoin. “Altcoins may need stronger fundamentals to benefit in the long term,” cautions Ryan Lee, lead analyst at Bitget Research, underscoring that in a tough economy investors will favor the most established cryptocurrencies over speculative ones. For now, Bitcoin and Ethereum remain the bellwethers: where they go, the rest of the market is likely to follow.

Crypto Bright Spots Amid Uncertainty

Despite the market’s recent drubbing, it’s not all gloom in the crypto world. The industry’s resilience and innovation continue to shine through the volatility. In fact, user adoption and engagement in crypto have remained robust, even as prices gyrate. Crypto enthusiasts are still finding new opportunities and platforms to participate in. For example, the gaming and entertainment side of crypto is thriving, providing a welcome diversion from market stress. Platforms like the BetFury crypto casino have continued to attract players with innovative rewards and provably fair gaming, showcasing how the broader crypto ecosystem keeps expanding regardless of short-term price action. Such projects, which allow users to wager and earn in cryptocurrencies, offer a reminder that real-world crypto use cases are growing. The success of BetFury and similar platforms is a positive signal – it suggests that crypto adoption is not limited to investing and trading, but also encompasses gaming, DeFi, NFTs, and other applications that can flourish even in choppy markets.

Moreover, ongoing developments in regulation and infrastructure are laying a foundation for the next phase of growth. Even the Trump administration, while causing turbulence with tariffs, has shown an openness to crypto-friendly measures in other areas (such as exploring a U.S. digital dollar and easing crypto banking rules. These moves could bolster long-term confidence in the asset class. Meanwhile, large institutions are still pressing ahead with crypto initiatives – new Bitcoin ETF filings, venture investments in blockchain startups, and global central banks experimenting with digital currencies. These under-the-radar positives suggest that once the macro dust settles, crypto markets could emerge stronger. Investor sentiment on the ground remains surprisingly upbeat in some circles: bitcoin conferences and online forums are buzzing with talk of “buying the dip” and positioning for the next bull cycle. While caution is prudent, the commitment of long-term believers is a reminder that crypto has endured and thrived through past adversities.

Conclusion: Navigating the Road Ahead – Practical Advice for Investors

In the wake of Trump’s tariff shock, crypto investors find themselves at a crossroads. The short-term outlook is dominated by uncertainty and potential downside, while the medium-term holds both risks and opportunities tied to broader economic trends. What should investors do now? Here is some practical, clear-cut guidance based on the analysis above and expert commentary:

- Stay Calm and Assess: First, avoid panic moves. Take stock of your portfolio’s risk exposure. If you are over-leveraged or over-invested in speculative altcoins, consider rebalancing toward quality assets or cash. Bitcoin and Ethereum, with their deep liquidity and institutional support, may be more resilient holdings than smaller tokens in this environment.

- Watch Key Levels for Entry Points: Keep an eye on support levels that experts are watching. For Bitcoin, the mid to high-$70,000s is a crucial zone; dips into that area have attracted institutional buyers. Some strategists even favor waiting for a potential flush toward ~$70K (or lower) to add positions gradually. For Ethereum, observe how it behaves around $1,500 – a sustained break below might signal caution, whereas a bounce from that level could be a green light for a small buy. Solana investors should monitor its recent lows; if SOL approaches price areas that long-term backers find attractive (for instance, retracing to levels seen before its last big rally), it could present a value opportunity – but only if one believes in its fundamentals.

- Hedge Macro Risks: Consider hedging against further macro turmoil. This could mean keeping a portion of your holdings in stablecoins or even in cash to deploy if prices drop significantly. It might also mean using stop-loss orders or options strategies to protect downside. Given the backdrop, it’s wise to be prepared for scenarios like a Bitcoin dip toward the low-$60Ks or even the ~$55K zone that some pessimistic forecasts suggest. Having some dry powder (capital on the sidelines) will allow you to act on opportunities that arise from any capitulation event.

- Focus on Fundamentals and Big-Picture Trends: In turbulent times, projects with strong fundamentals and clear use cases are more likely to weather the storm. Bitcoin’s thesis as a long-term store of value in a de-dollarizing world could gain traction if the trade war drags on – so maintaining a core BTC position makes sense for believers. Ethereum’s role in decentralized finance and its upcoming technical upgrades could drive a recovery once immediate panic subsides. Solana’s high throughput and growing ecosystem, while under pressure now, could rebound if it continues to attract developers and users. Do your homework on any asset you hold; make sure the investment case still holds up in this new macro environment.

- Stay Informed, Be Nimble: Finally, closely follow developments in U.S. policy and global economic news. Any sign of a truce in the trade war or a policy U-turn (for example, a pause or reduction in tariffs) could spark a relief rally in crypto. Conversely, escalation – such as major trading partners retaliating with their own tariffs – might bring another leg down. Also watch the Federal Reserve’s signals: if rate cuts or other easing measures are hinted, that could be a cue that the worst may pass for risk assets. Be ready to adjust your strategy as new information comes in. This may mean setting alerts for key news or price thresholds, and deciding in advance what actions to take in different scenarios (so you’re not making decisions on pure emotion in the moment).

In summary, the crypto market’s short-term path is likely to be bumpy as it digests the impact of Trump’s tariffs. Prices could certainly fall further if macroeconomic conditions deteriorate – Bitcoin in the $60,000s or Ether in the low $1,000s are not out of the question according to some analysts. But there is also a case to be made that crypto will adapt and find its footing, especially if the situation forces favorable shifts like a weaker dollar or renewed monetary stimulus. Seasoned crypto investors know that volatility comes with the territory. The best course now is to stay level-headed and strategic: focus on high-conviction assets, keep an eye on the macro triggers, and be ready to act (whether to cut losses or to buy aggressively) when the time is right. As always in crypto, fortune favors the well-informed and the patient – those who can weather the storm today stand to reap the rewards when the skies eventually clear.